lakewood sales tax license

Rather than having to get in contact. The PIF is a fee and NOT a tax.

Wayfair Challenges Local Colorado Sales Tax Burden

Service-oriented businesses that do not sell anything are required to obtain a use.

. The minimum combined 2022 sales tax rate for Lakewood Colorado is. Learn more about sales and use tax public improvement fees and find resources and publications. What is the sales tax rate in Lakewood Washington.

Without help from Business Licenses LLC it can be challenging to even understand all the steps to getting your Lakewood Colorado sales tax permit. You have been successfully logged out. Close Sales Tax Account.

This is the total of state county and city sales tax rates. Sales Use Tax. Rather than having to get in contact.

Applicants can also choose to complete the online application in person. If you are filing taxes after the event and do not have a license you. Determine if your business needs to be licensed with the City and apply online.

Your session has expired. The City of Lakewood receives 1 of the 100 sales tax rate. Business Licensing Tax.

City of Lakewood 10. Without help from Business Licenses LLC it can be challenging to even understand all the steps to getting your Lakewood Minnesota sales tax permit. Business License Application and City Addendum.

Learn more about transactions subject to Lakewood salesuse tax. Renew a Sales Tax License. All businesses operating in Lakewood must obtain a City of Lakewood sales and use tax license.

The breakdown of the 100 sales tax rate is as follows. This is the total of state county and city sales tax rates. Texas imposes a 625 state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

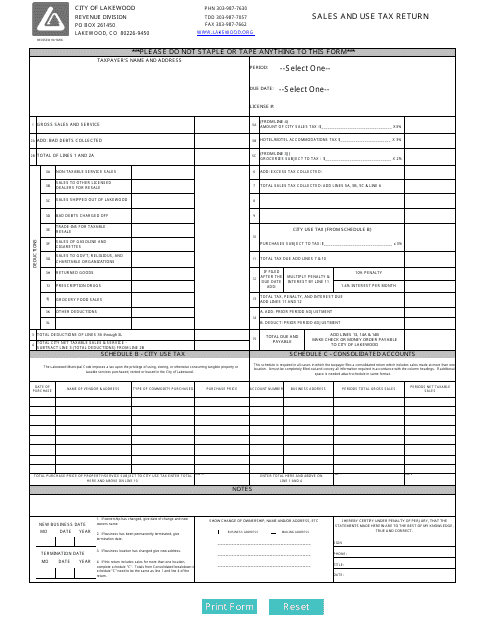

A Public Improvement Fee PIF is a fee that developers may require their tenants to collect on sales transactions to pay for on-site improvements. Complete the following and mail to. Measure L Improvement Projects Lakewood Online Contact the Lakewood Finance Department with.

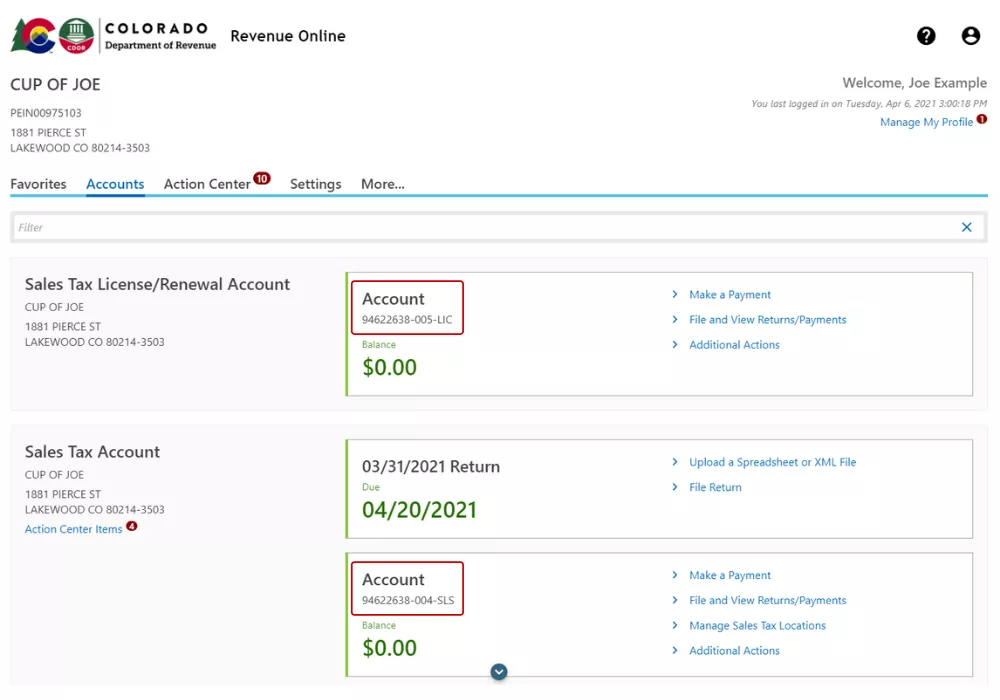

License file and pay returns for your business. You will be automatically redirected to the home page or you may click below to return immediately. You may now close this window.

The Colorado sales tax rate is currently. The Colorado sales tax rate is currently. The minimum combined 2022 sales tax rate for Lakewood Washington is.

An application can be completed online in Lakewood Business Pro accessed via. Lakewood Village imposes a 150. Add Locations to Your Account.

Contact the Lakewood Finance Department with questions regarding your sales and use tax license by calling 303 987-7630 or visit them in person at 480 South Allison Parkway in. To apply for the Single Event License prior to the event use the Special Event Sales Tax Application DR 0589. If you are not sure if you will do.

New Cars Trucks Suvs For Sale Lakewood Ford

Lakewood Speaks Item 10 Ordinance O 2021 24 Short Term Rentals

Used Trucks For Sale Nj Car Dealers In Ocean County Nj Nj Auto Depot

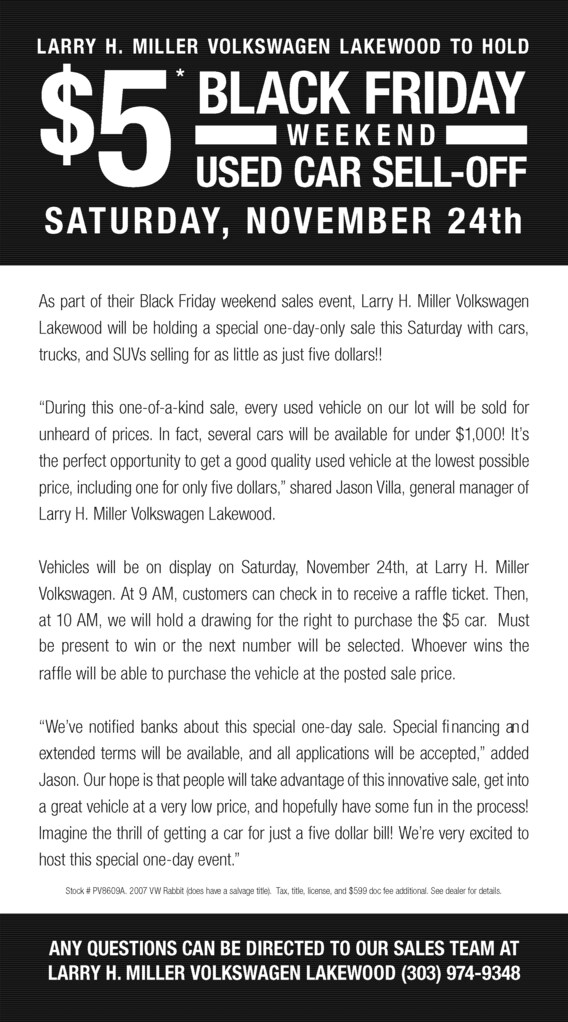

5 Car Sale Denver Volkswagen Dealership Sale Larry H Miller Volkswagen Lakewood

Business Licensing City Of Lakewood

How To Register For A Sales Tax Permit In Georgia Taxvalet

Eagle Ridge Golf Eagleridgeglf Twitter

Business Licensing Tax City Of Lakewood

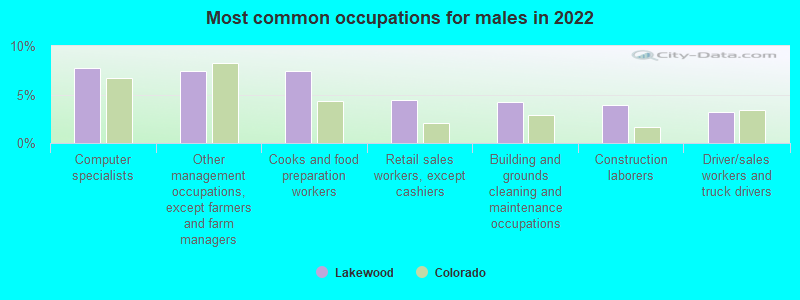

Lakewood Colorado Co 80228 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

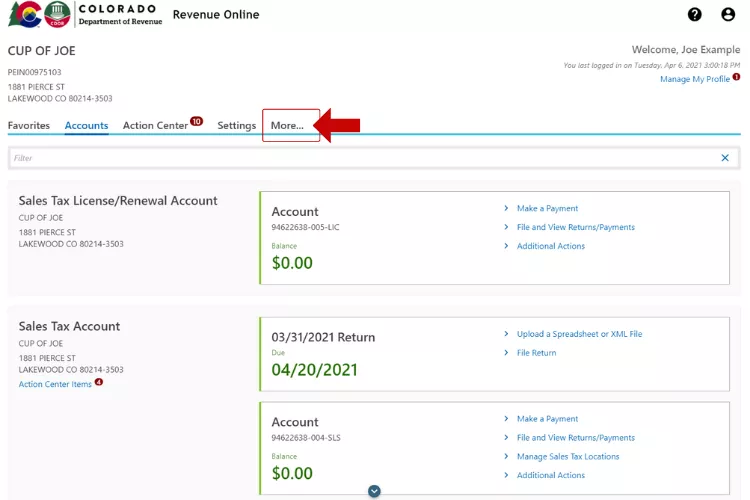

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Register For A Sales Tax Permit Taxjar

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

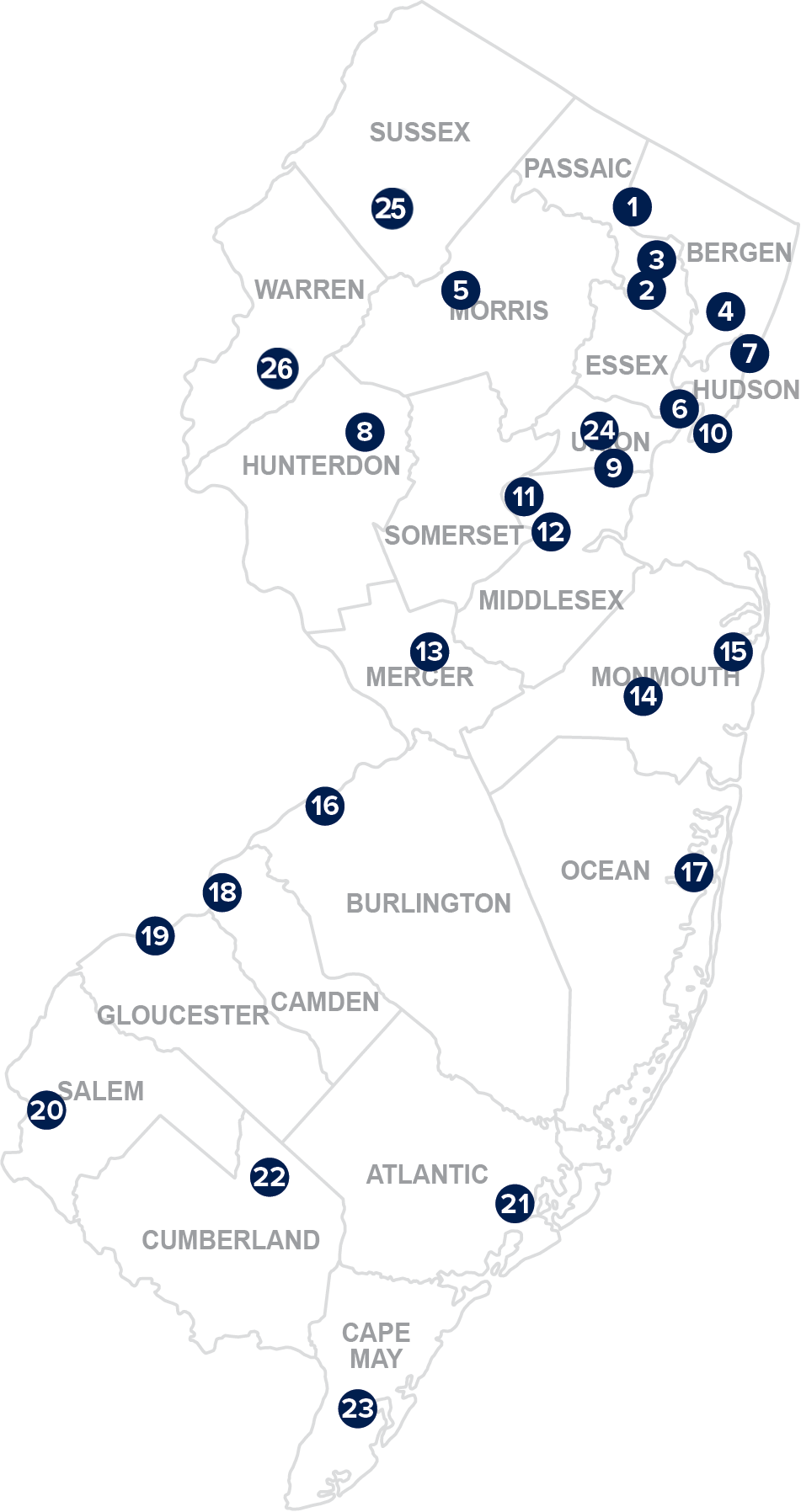

Official Site Of The State Of New Jersey

Send A Secure Message In Revenue Online Department Of Revenue Taxation

Short Term Rental Tax Information Summit County Co Official Website

New 2023 Porsche Cayenne Platinum Edition Denver Co Lakewood Boulder 230004

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation